Google yesterday rolled out their Google Pay app for a Android. Before we get into why they’re doing this and what it means for marketers let’s quickly touch on what it is exactly.

In essence Google Pay itself is a fairly basic concept. You connect your Google Account to your credit cards and then you can use your account to pay for goods and services. Basically – it’s a middle-man in a transaction like most processors. Vendors can sign up to support Google Pay online and it’s rolling out into the real world allowing users of transit in cities like London and Portland to use their phone as their pass. To ask Google … it’s a beefed up Android Pay.

I like systems like this as it allows me to pay with a credit card but only give a single company that card information.

In the coming few months according to Google, you’ll be able to use it more like PayPal and send and receive money as well.

So Why Should Marketers Care?

Back in 2011 I wrote an article for Search Engine Watch answering the question, “Why would Google become a bank?” Technically they’ve been a bank since 2007 and in essence it’s about tracking more than it is direct revenue which will make them a very serious threat to companies like PayPal should they gain the adoption with Google Pay that they’re clearly looking for.

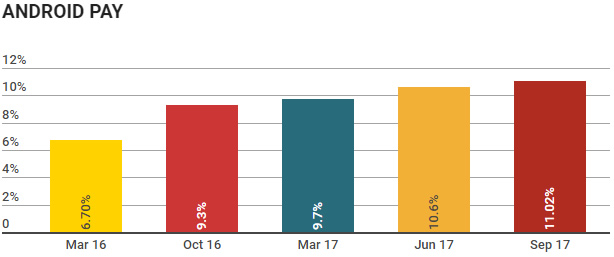

But let’s look at the adoptions rate of the Android Pay wallet (which has been turned into Google Pay).

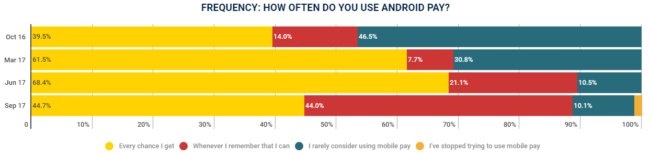

So – they’ve been used but the data here is simply for “have you tried it” not “so you use it regularly”. That looks more like:

So really only about 5% of people are using Android Pay regularly.

But consider for a moment a world where they can get that adoption rate up. If they can pull vendors in with low transaction fees (remember – this isn’t where the money is for Google so if they can just break even on this stage and win … something most other solutions can’t do) and can get us all convinced of the security and used to using it for daily tasks (like transit passes) they could easily significantly boost their use rates.

The win here for Google is in the information. Gaining access to information on user transactions and even non-transacting engagements (like getting on a subway) will pour data to Google. More than that, it would also push users to log in with the same account on their mobile device and their desktop for payment convenience.

All this makes for unparalleled conversion tracking. And the best part (for us as marketers) is that gaining an unmatched understanding of the lifetime value of a client and using that in our online marketing efforts such as bid management and targeting would be far easier and integrated (likely) into AdWords itself. This of course would translate into a higher value on our bids (if we know a conversion on a phrase tends to result in multiple sales over time we’ll certainly bid higher on it).

One can only assume as well that vendors that support Google Pay in the real world will be able to target users in their local ads (coffee anyone?) that Google knows are setup to use it adding another level of targeting.

We’re at really the very early stages of this. Down the road I expect to see a lot more adoption of the wallets but not just as a payment system but also a system for organizing your reward cards, etc. Why have a wallet full of cards to track your coffee intake and get you that freebie? If the shop supports Google Pay it would be a no brainer to add the functionality to track use and keep track of rewards and I’m certain we’ll see it soon. And then you can start targeting ads to the folks with your rewards cards too (perhaps those who haven’t been in a while).

What we’re seeing, if successful and I suspect that it will be though perhaps not to a significant level for 2 or 3 years, is the consolidation of new data types and targeting capabilities. It’s extremely exciting for me as a marketer if not a bit creepy.